With the Australian federal election coming, both the Labor and the Liberal/National Coalition parties have announced policies to buy votes.

Labor will

provide help for Australians on low and middle incomes to buy houses by giving eligible applicants a commonwealth equity contribution of up to 40% of the purchase price of a new home, and up to 30% for an existing home.

The Coalition will

first home buyers will be able to invest up to 40 per cent of their superannuation, up to a maximum of $50,000 to help with the purchase of their first home.

Let’s just ignore the stupidity of these idea - giving people free money causes something called inflation and whilst inflation can be a good thing, a Government causing inflation, without it being a byproduct of economic growth is just wrong. Labor and the Coalition aren’t alone in wrongly splashing taxpayer’s assets (because that’s what they are!) to buy an election, most (all?) of the parties do it.

Housing affordability

The issue they are trying to address is that of housing affordability. To give you an indication of the scale of problem (opportunity?), Australia has less than 8% of the population of the US (26m compared to 330m) yet the total value of our residential real estate market, i.e. our housing, is around one quarter that of the US - that’s right - our properties are around 3x more (0.25 / 0.8) expensive.

Naturally, these prices make it extremely hard for people to enter the housing ownership market and make the rental market extremely competitive too.

Governments have attempted to address this price imbalance in a few different ways.

Purchasing power - Australia vs. USA

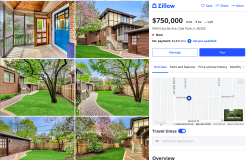

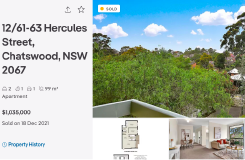

Here are two AU$1m (US$700k) properties. They are both about 20-30 minutes travel on train to the respective city centres.

The first is a house in Oak Park, Illinois (Zillow, archived). Four bedrooms, three bathrooms, den, office, outdoor space. On Google Maps.

The second one is an apartment in Chatswood, Sydney (REA, archived). Two bedrooms, one bathroom and a small balcony. On Google Maps.

This is the difference in purchasing power between the two countries.

Wrong approach #1 - Grants

Governments love buying affection. Labor’s shared ownership scheme, the Coalition’s First Home Guarantee scheme, various government’s first home-owner’s grants all fail the basic reasonableness test. They don’t work, they cause price inflation and hurt the very group they are purporting to help by making it even harder for them to buy their next property. However, they look good and, in the short-term, buy votes.

Wrong approach #2 - More development

The other common line that is parroted is that there is a shortage of housing and that we need to increase supply to reduce competitive price pressures.

This is correct and a valid solution, it is also predicated on the assumptions that there is a supply shortage and that there are no (or limited) negative impacts in building more residences.

We know that the second part is not true. More building means extending cities out further impacting our environment, extending further means increased need for infrastructure, building (and concrete in particular) is often horrendous for the environment, increased travel time - with associated pollution and mental health impacts, etc.

What about the first part? Is there a shortage of housing?

Property ownership and money laundering

There is a problem with the claim that there is a shortage of housing. There is no evidence for it. Increased prices and reduced rental vacancies are correlated with a shortage of properties, but they aren’t proof of a shortage.

There have been investigations into property usage where off-the-plan purchases haven’t been occupied. The suggestion is that these properties are not being purchased as owner-occupied housing, or as investment properties, but simply as a way to launder money - exfiltrating capital from other countries.

There have been investigations finding, in some areas, significant percentages of newly-built properties are being purchased and then not used. Buying a productive asset and not using it to generate revenue is unusual. Having it occur at scale, is suspicious.

How do we see if a property is being used? One simple way is to look at the water usage. People need to drink, bathe, use the toilet. This results in a different water usage profile than an unoccupied property with dripping taps.1, 2

A subsequent problem - unique addresses?

Another problem we have proving or disproving the property shortage is the fact that Australia does not have a source of truth for addresses.

Take the last two properties where I have lived In Sydney. In each case according to one part of the state government my address was one thing, according to another part it was different and according to the NBN my address was yet different again.

Without a consistent address mapping, assessing occupancy amongst other things becomes difficult.

The problem. A solution?3

There is no incentive for many of the groups with financial clout involved to resolve this issue:

- Wealthy elites in some, less-than-democratic, countries want to keep laundering their money; buying Australian property with limited to no oversight is an easy (and possibly profitable4) way to launder assets.

- Construction companies get paid to build properties - it’s their fiduciary duty to do this when they are able

- Government’s and opposition parties want to run the country

- it’s easier to dole out money and deal with the repercussions after an election

- election campaigns are expensive so donations are important

- fixing this known problem5 is hard and will take some time whilst impacting #1 and #2 above

- Councils and groups with development approval rights have a history of decision making not aligned with the public interest

What’s the solution? I don’t know. Maybe unoccupied properties should be taken and used for public housing or lower-income rentals, with the income used to pay for services? Could better reporting of property ownership to reduce this buy-and-hold strategy?

What I do know is that I wish that the media did more research before reporting on real estate - lazy reporting is harmful for so many parts of our community.

This problem is not limited to Australia. It is however timely with our upcoming election.

-

Of course, if you were laundering your money and this method for assessing was implemented then you’d just hire some people to come around and flush your toilets a few times each day. ↩︎

-

Don’t forget Campbells law - the more important a metric is in social decision making, the more likely it is to be manipulated. ↩︎

-

Obviously the answer is No - see Betteridge’s law of headlines ↩︎

-

If we take (completely random) sources on the internet, laundering fees start at 20%, depending on size and How quickly you need to act. Compare that to the average price rise of 23.7% for Australian property over the last 12 months, laundering through Australian property starts to look very attractive. ↩︎

-

These problems are well known. When I was at CoreLogic the CEO made a submission to a Federal Government review on this foreign ownership topic. ↩︎